(Rule 14a−101)

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | ☑ |

| | Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, Forfor Use of the Commission Only (as permitted by Rule 14a−6(e)14a-6(e)(2)) |

☑☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to Section 240.14a−12Under §240.14a-12 |

Ocuphire Pharma, Inc.

Rexahn Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | | | Fee computed on table below per Exchange Act Rules 14a−6(i)14a-6(i)(1) and 0−11.0-11. |

| (1) | | 1) | | | Title of each class of securities to which transaction applies: |

| (2) | | | | | | | | | 2) | | | Aggregate number of securities to which transaction applies: |

| (3) | | | | | | | | | 3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0−110-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | | | | | | | | | 4) | | | Proposed maximum aggregate value of transaction: |

| (5) | | | | | | | | | 5) | | | Total fee paid: |

☐ | | | | | | | ☐ | | | Fee paid previously with preliminary materials. |

☐ | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0−11(a)0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | | 1) | | | Amount Previously Paid: |

| (2) | | | | | | | | | 2) | | | Form, Schedule or Registration Statement No.: | | | | | | | | | | | 3) | | | Filing Party: | | | | | | | | | | | 4) | | | Date Filed: | | | | | | | |

REXAHN PHARMACEUTICALS, INC.

TABLE OF CONTENTS NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 26, 2021

To be held April 11, 2017Dear Stockholder:

To our shareholders:

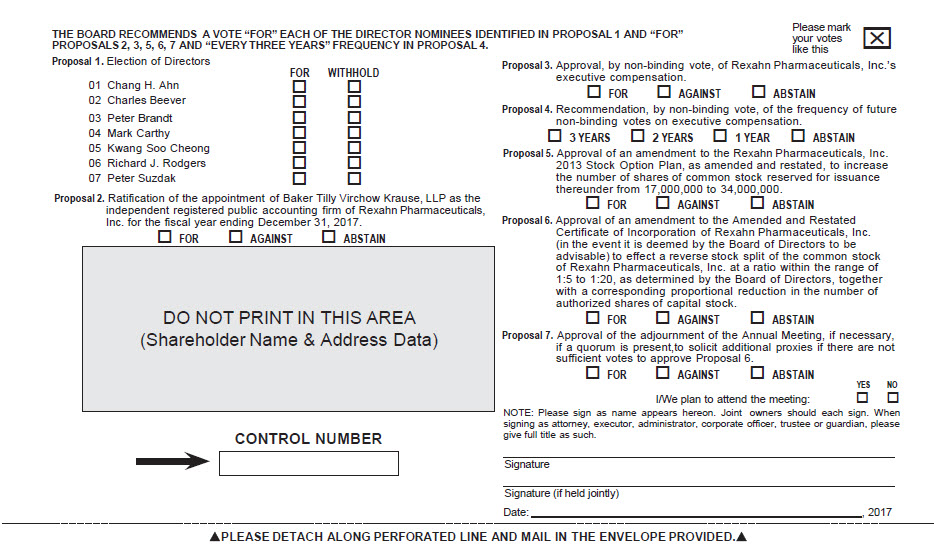

Notice is hereby given that the Annual Meeting of the Shareholders (the “Annual Meeting”) of Rexahn Pharmaceuticals, Inc. (the “Company”) will be held on April 11, 2017, at 8:00 a.m. (local time), at the Radisson Hotel, 3 Research Court, Rockville, Maryland 20850. The Annual Meeting is called for the following purposes:

| 1. | to elect as directors the seven nominees named in the accompanying proxy statement to a term of one year each, or until their successors have been elected and qualified; |

| 2. | to ratify the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2017; |

| 3. | to approve, by non-binding vote, the Company’s executive compensation; |

| 4. | to recommend, by non-binding vote, the frequency of future non-binding votes on executive compensation; |

| 5. | to approve an amendment to the Rexahn Pharmaceuticals, Inc. 2013 Stock Option Plan, as amended and restated, to increase the number of shares of common stock reserved for issuance thereunder from 17,000,000 to 34,000,000;

|

| 6. | to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (in the event it is deemed by the Board of Directors to be advisable) to effect a reverse stock split of the Company’s common stock at a ratio within the range of 1:5 to 1:20, as determined by the Board of Directors, together with a corresponding proportional reduction in the number of authorized shares of the Company’s capital stock; |

| 7. | to approve the adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 6; and |

| 8. | to consider and take action upon such other matters as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

The Board of Directors has fixed February 21, 2017 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to receive notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

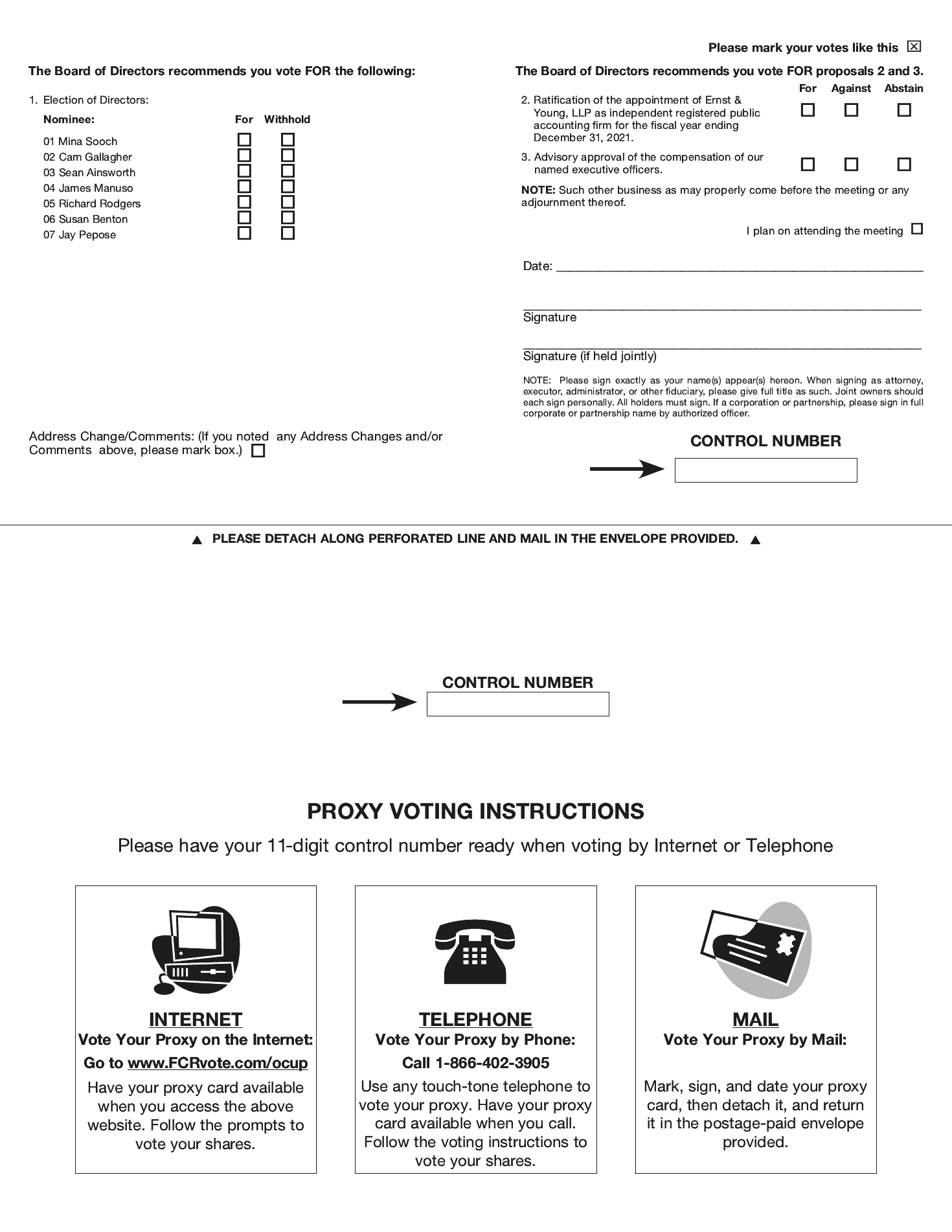

You are cordially invited to attend the 2021 Annual Meeting. Meeting of Stockholders (the “Annual Meeting”) of Ocuphire Pharma, Inc. to be held at 37000 Grand River Avenue, Suite 120, Farmington Hills, Michigan 48335, on June 7, 2021 at 4:00 p.m. local time. The enclosed Notice of 2021 Annual Meeting of Stockholders and the Proxy Statement contain details of the business to be conducted at the Annual Meeting and information you should consider when you vote your shares. At the Annual Meeting, the agenda includes: (1) to elect seven directors named in the Proxy Statement, each to serve a one-year term, (2) to ratify the appointment our independent registered public accounting firm for the fiscal year ending December 31, 2021 and (3) to approve our named executive officers’ compensation in an advisory vote. The Board of Directors unanimously recommends that you vote “FOR” the election of each of the director nominees, “FOR” the ratification of the appointment of our independent registered public accounting firm and “FOR” the approval of the advisory vote to approve our named executive officers’ compensation. Your vote is important. We currently intend to hold the Annual Meeting in person. However, in the event we determine it is not possible or advisable to hold the Annual Meeting in person, we will publicly announce alternative arrangements for the Annual Meeting as promptly as practicable before the Annual Meeting, which may include holding the Annual Meeting solely by means of remote communication (i.e., a virtual-only Annual Meeting). Please monitor our website at www.ocuphire.com for updated information. Whether or not you expect to attend you are respectfully requested by the Board of DirectorsAnnual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly either sign, datevote by submitting your proxy via the Internet at the address listed on the proxy card, by telephone at the number listed on the proxy card, or by signing, dating, and returnreturning the enclosed proxy card or vote via the Internet or by telephone by following the instructions provided on the proxy card. A return envelope, which requires no postage if mailed in the United States, is enclosed forenvelope. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your convenience.proxy. | | | Sincerely, | | | | | | | | | | | | | By Order of the Board of Directors, | |  | | Mina Sooch

President and Chief Executive Officer |

TABLE OF CONTENTS NOTICE OF 2021 ANNUAL

MEETING OF STOCKHOLDERS WHEN | | | June 7, 2021 at 4:00 p.m. local time | | Peter Brandt | | | | | | WHERE | Chairman of the Board of Directors | | 37000 Grand River Avenue, Suite 120, Farmington Hills, MI 48335* | February 24, 2017 | | | | | | |

PURPOSE OF MEETING AND AGENDA | | | Important Notice RegardingAt the Availability of Proxy Materials for the

2021 Annual Meeting, of Shareholders stockholders will vote: | | | | 1. | | | to be Held on April 11, 2017:

Copies of our Proxy Materials, consisting of the Notice of Annual Meeting,elect seven directors named in the Proxy Statement, andeach to serve for a one-year term;

| | | | 2. | | | to ratify the appointment of our 2016independent registered public accounting firm for 2021; and | | | | 3. | | | to approve our named executive officers’ compensation in an advisory vote. | | | | | | | | | | | Stockholders also will transact any other business that may properly come before the meeting or any adjournment or postponement thereof. | | | | | | | | WHO CAN VOTE | | | Stockholders of record at the close of business on April 15, 2021. | | | | | | | | VOTING | | | Your vote is very important. Please submit your proxy or voting instructions as soon as possible, whether or not you plan to attend the Annual ReportMeeting. | | | | | | | | ADMISSION TO THE ANNUAL MEETING | | | All of our stockholders are availableinvited to attend the Annual Meeting. If you attend, you will need to bring valid, government-issued photo identification. The doors to the meeting room will be closed promptly at http://www.viewproxy.com/rexahn/2017 the start of the meeting. |

*

| We currently intend to hold the Annual Meeting in person. However, in the event we determine it is not possible or advisable to hold the Annual Meeting in person, we will publicly announce alternative arrangements for the Annual Meeting as promptly as practicable before the Annual Meeting. Please monitor our website at www.ocuphire.com for updated information. |

Sincerely, Mina Sooch

President and Chief Executive Officer Farmington Hills, Michigan

April 26, 2021 REXAHN PHARMACEUTICALS,TABLE OF CONTENTS OCUPHIRE PHARMA, INC.

15245 Shady Grove Road, Suite 455

Rockville, Maryland 20850

(240) 268-5300

PROXY STATEMENT

FOR 2021 ANNUAL MEETING OF SHAREHOLDERS STOCKHOLDERS

To be held April 11, 2017

TABLE OF CONTENTS This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the

TABLE OF CONTENTS OCUPHIRE PHARMA, INC. PROXY STATEMENT FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS GENERAL INFORMATION ABOUT THE MEETING Our Board of Directors of Rexahn Pharmaceuticals, Inc. (“we”, “us”, or(the “Board”) solicits your proxy on our behalf for the “Company”) for the2021 Annual Meeting of Shareholders to be heldStockholders (the “Annual Meeting”) and atthe Radisson Hotel, located at 3 Research Court, Rockville, Maryland 20850, on April 11, 2017, at 8:00 a.m. (local time) and for any postponement or adjournment thereof (the “Annual Meeting”),of the Annual Meeting for the purposes set forth in the accompanyingthis Proxy Statement. The Annual Meeting will be held at 37000 Grand River Avenue, Suite 120, Farmington Hills, Michigan 48335 on Monday, June 7, 2021 at 4:00 p.m. local time. On or about April 26, 2021, we intend to mail to our shareholders of record a Notice of Annual MeetingInternet Availability of Shareholders.

We are providing our Proxy Materials (the “Notice”). The Notice will contain instructions on how to record shareholders by sending a printed copy of the full set of our proxy materials (the “Proxy Materials”), consisting of the Notice of Annual Meeting,access this Proxy Statement and our 2020 annual report to stockholders, through the Internet and how to vote through the Internet. The Notice also will include instructions on how to receive such materials, at no charge, by paper delivery (along with a proxy card (the “Proxy Card”), and our 2016 Annual Reportcard) or by e-mail. Beneficial owners will receive a similar notice from their broker, bank, or other nominee. Please do not mail in the Notice, as it is not intended to Shareholders by mail. As permitted by Securities and Exchange Commission (“SEC”) rules, we are also providing accessserve as a voting instrument. Notwithstanding anything to the Proxy Materialscontrary, we may send certain stockholders of record a full set of proxy materials by paper delivery instead of the notice or in addition to sending the notice.

We currently intend to hold the Annual Meeting in person. However, in the event we determine it is not possible or advisable to hold the Annual Meeting in person, we will publicly announce alternative arrangements for the Annual Meeting as promptly as practicable before the Annual Meeting. Please monitor our website at www.ocuphire.com for updated information. Unless we state otherwise or the context otherwise requires, references in this proxy statement to “we,” “our,” “us”, or the “Company” are to Ocuphire Pharma, Inc., a Delaware corporation. Purpose of the Annual Meeting At the Annual Meeting, stockholders will act upon the proposals described in this proxy statement. In addition, we will consider any other matters that are properly presented for a vote at the meeting. We are not aware of any other matters to be submitted for consideration at the meeting. If any other matters are properly presented for a vote at the meeting, the persons named in the proxy, who are officers of the Company, have the authority in their discretion to vote the shares represented by the proxy. Record Date; Quorum Only holders of record of the Company’s common stock, par value of $0.0001 per share (the “Common Stock”), at the close of business on April 15, 2021, the Internet.

record date, will be entitled to vote at the Annual Meeting. At the close of business on April 15, 2021, 11,749,172 shares of Common Stock were outstanding and entitled to vote.

The Proxy Statementholders of a majority of the voting power of the outstanding shares of stock entitled to vote must be present in person or by proxy in order to hold the meeting and accompanying formconduct business. This presence is called a quorum. Your shares are counted as present at the meeting if you are present and vote in person at the meeting or if you have properly submitted a proxy. Voting Rights; Required Vote Each holder of proxyshares of Common Stock is entitled to one vote for each share of Common Stock held as of the close of business on April 15, 2021, the record date. You may vote all shares owned by you at such date, including (1) shares held directly in your name as the stockholder of record and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee or other nominee. Dissenters’ rights are firstnot applicable to any of the matters being mailed to stockholdersvoted on. Stockholder of Record: Shares Registered in Your Name. If on or about March 3, 2017. QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

Q: | Why are these materials being made available to me? |

A: | The Proxy Materials are being provided to you in connection with the Annual Meeting and include this Proxy Statement and the related Proxy Card that are being used in connection with the Board of Directors’ solicitation of proxies for the Annual Meeting. The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process and certain other required information. |

Q: | How do I access the Company’s Proxy Materials online? |

A: | The Proxy Card provides instructions for accessing the Proxy Materials over the Internet, and includes the Internet address where those materials are available. The Company’s Proxy Statement for the Annual Meeting and the Company’s 2016 Annual Report to Shareholders can also be viewed on the Company’s website at www.rexahn.com.

|

Q: | What shares owned by me can be voted? |

A: | All shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”) owned by you as of the close of business on the Record Date may be voted by you. Each share of Common Stock is entitled to one vote. These shares include those (1) held directly in your name as the shareholder of record (“Shareholder of Record”), and (2) held for you as the beneficial owner through a broker, bank or other nominee.

|

Q: | What is the Record Date? |

A:

| The Record Date is February 21, 2017. Only Shareholders of Record as of the close of business on this date will be entitled to vote at the Annual Meeting.

|

Q: | How many shares are outstanding? |

A: | As of the Record Date, the Company had 237,443,785 shares of Common Stock outstanding. |

Q: | What is the difference between holding shares as a Shareholder of Record and as a beneficial owner? |

A: | As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Shareholder of Record

IfApril 15, 2021, your shares arewere registered directly in your name with the Company’sour transfer agent, American Stock Transfer & Trust Company, LLC, then you are considered the stockholder of record with respect to those shares,shares. As a stockholder of record, you may vote at the Shareholder of Record. As the Shareholder of Record, you have the right to grant your voting proxy directly to the Companymeeting, or to vote in person atadvance through the Annual Meeting.Internet, by telephone or by mail.

TABLE OF CONTENTS Beneficial Owner

Owner: Shares Registered in the Name of a Broker or Nominee. If on April 15, 2021, your shares arewere held in an account with a stock brokerage account or by afirm, bank or other nominee, then you are considered the beneficial owner of the shares held in “street name” and your broker, bank or other nominee is considered, with respect to those shares, the Shareholder of Record.street name. As thea beneficial owner, you have the right to direct your broker bank or nominee on how to vote and are also invited to attend the Annual Meeting. However, because you are not the Shareholder of Record, you may not vote these shares held in person at the Annual Meeting unless you receive a proxy fromyour account, and your broker bankhas enclosed or other nominee. Your broker, bank or other nominee has provided voting instructions for you to use. Ifuse in directing it on how to vote your shares. Because the brokerage firm, bank or other nominee that holds your shares is the stockholder of record, if you wish to attend the meeting and vote your shares you must obtain a valid proxy from the firm that holds your shares giving you the right to vote the shares at the meeting. Votes Required to Adopt Proposals. Each director will be elected by a plurality of the votes of shares present in person or represented by proxy at the Annual Meeting and entitled to vote in person, please contact your broker, bank or other nominee soon the election of directors. This means that you can receive a legal proxythe individuals nominated for election to presentthe Board at the Annual Meeting.Meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” each nominee or “WITHHOLD” your vote with respect to each nominee. You may not cumulate votes in the election of directors. Approval of Proposals 2 and 3 will be obtained if the holders of the majority of voting power of the shares present in person, by remote communication, if applicable, or represented by proxy at the Annual Meeting and entitled to vote at the Annual Meeting vote “FOR” such proposal.

A: | You are being asked to vote on (1) the election as directors of the seven nominees named in this Proxy Statement to a term of one year each, or until their successors have been elected and qualified, (2) the ratification of the appointment of Baker Tilly Virchow Krause, LLP (“Baker Tilly”) as the independent registered public accounting firm of the Company for the year ending December 31, 2017, (3) the approval, by non-binding vote, of the Company’s executive compensation, (4) the recommendation, by non-binding vote, of the frequency of future non-binding votes on executive compensation, (5) the approval of an amendment to the Rexahn Pharmaceuticals, Inc. 2013 Stock Option Plan, as amended and restated (the “2013 Plan”) to increase the number of shares of Common Stock reserved for issuance thereunder from 17,000,000 to 34,000,000, (6) the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation (in the event it is deemed by the Board of Directors to be advisable) to effect a reverse stock split of the Company’s Common Stock at a ratio within the range of 1:5 to 1:20, as determined by the Board of Directors, together with a corresponding proportional reduction in the number of authorized shares of the Company’s capital stock, and (7) the approval of the adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 6.

|

A proxy submitted by a stockholder may indicate that the shares represented by the proxy are not being voted (stockholder withholding) with respect to a particular matter. In addition, a broker may not be permitted to vote on shares held in street name on a particular matter in the absence of instructions from the beneficial owner of the stock (broker non-vote). The shares subject to a proxy which are not being voted on a particular matter because of either stockholder withholding or broker non-votes will count for purposes of determining the presence of a quorum. Abstentions and broker non-votes will have no effect on Proposal 1. For Proposals 2 and 3, abstentions, if any, will not be treated as present and entitled to vote at the Annual Meeting and thus will have no effect on the outcome of this proposal unless you return your annual proxy or attend the Annual Meeting and select “ABSTAIN”. Broker non-votes, if any, will have no effect on any of the proposals.

The Company isBoard recommends a vote “FOR” each of the director nominees listed in this proxy statement, “FOR” the ratification of Ernst & Young, LLP’s appointment as our independent registered accounting firm and “FOR” the approval, on an advisory basis, of the compensation of our named executive officers. Voting Instructions; Voting of Proxies If you are a stockholder of record, you may: Vote in person — we will provide a ballot to stockholders who attend the Annual Meeting and wish to vote in person. Submitting a proxy will not currently aware of any mattersprevent a stockholder from attending the Annual Meeting, revoking their earlier-submitted proxy, and voting in person. Vote through the Internet — you may vote through the Internet. To vote by Internet, you will need to use a control number provided to you in the materials with this proxy statement and follow the additional steps when prompted. The steps have been designed to authenticate your identity, allow you to give voting instructions, and confirm that those instructions have been recorded properly. Vote by telephone — if you received your annual meeting materials by paper delivery, you may vote by telephone as indicated on your enclosed proxy card or voting instruction card. To vote by telephone, you will be broughtneed to use a control number provided to you in the materials with this proxy statement and follow the voting instructions. Vote by mail — complete, sign and date the accompanying proxy card and return it as soon as possible before the Annual Meeting (other than procedural matters) that are not referred to in the enclosed Proxy Card. If any other business should properly come beforeenvelope provided. Votes submitted through the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on June 6, 2021. Submitting your proxy, whether through the Internet, by telephone or by mail, will not prevent a stockholder from attending the Annual Meeting, revoking their earlier-submitted proxy, and voting in person. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct it on how to vote your shares. You may either vote “FOR” the nominee to the Board, or any postponementyou may withhold your vote from the nominee. For Proposals 2 and 3, you may vote “FOR” or adjournment thereof,“AGAINST” or “ABSTAIN” from voting. Your vote is important. Whether or not you plan to attend the persons namedAnnual Meeting, we urge you to vote by proxy to ensure that your vote is counted. TABLE OF CONTENTS All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will vote on such matters according to their best judgment. Discretionary authority to vote on such matters is conferred by such proxies uponbe voted in accordance with the persons voting them.

A: | Shareholders of Record may vote by completing and signing the enclosed Proxy Card and returning it promptly in the enclosed postage prepaid, addressed envelope, or at the Annual Meeting in person. We will pass out written ballots to anyone who is eligible to vote at the Annual Meeting. We also will request persons, firms, and corporations holding shares of the Company’s Common Stock in their names or in the name of their nominees, which are beneficially owned by others, to send proxy material to and obtain proxies from the beneficial owners and will reimburse the holders for their reasonable expenses in so doing. Proxy Cards properly executed and delivered by shareholders (by mail or via the Internet) and timely received by the Company will be voted in accordance with the instructions contained therein. If you authorize a proxy to vote your shares over the Internet or by telephone, you should not return a Proxy Card by mail, unless you are revoking your proxy. If you hold your shares in “street name” through a broker, bank or other nominee, and are therefore not a Shareholder of Record, you must request a legal proxy from your broker, bank or other nominee in order to vote at the Annual Meeting. |

recommendations of our Board stated above. If you do not vote and you hold your shares in “street name”street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes”. If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please complete, sign and return each proxy card to ensure that all of your shares are voted. Expenses of Soliciting Proxies We will pay the expenses associated with soliciting proxies. Following the original distribution and mailing of the solicitation materials, we or our agents may solicit proxies by mail, electronic mail, telephone, facsimile, by other similar means, or in person. Our directors, officers and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, e-mail or otherwise. Following the original distribution and mailing of the solicitation materials, we will request brokers, custodians, nominees and other record holders to forward copies of those materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, we, upon the request of the record holders, will reimburse such holders for their reasonable expenses. Revocability of Proxies A stockholder of record who has given a proxy may revoke it at any time before the closing of the polls by the inspector of elections at the meeting by: delivering to our Secretary (by any means, including facsimile) a written notice stating that the proxy is revoked; signing and delivering a proxy bearing a later date; voting again through the Internet or by telephone; or attending and voting at the Annual Meeting (although attendance at the meeting will not, by itself, revoke a broker,proxy). Please note, however, that if your shares are held of record by a brokerage firm, bank or other nominee and you may vote viawish to revoke a proxy, you must contact that firm to revoke or change any prior voting instructions. Voting Results Voting results will be tabulated and certified by the Internetinspector of elections appointed for the Annual Meeting. The preliminary voting results will be announced at the Annual Meeting. The final results will be tallied by going to www.proxyvote.com, while Shareholdersthe inspector of Record may go to www.aalvote.com/rnn to vote viaelections and filed with the Internet. All shareholders must have their control numberSecurities and Exchange Commission (the “SEC”) in order to vote viaa current report on Form 8-K within four business days of the Internet.Annual Meeting. TABLE OF CONTENTS ELECTION OF DIRECTORS Our Board currently consists of seven directors. Alan Meyer will not stand for re-election at the Annual Meeting. The Board has re-nominated the remaining six current directors and has also nominated Jay Pepose as a new nominee.

A:Mina Sooch | Forty percent | | 53 | | | Director and President and Chief Executive Officer | Cam Gallagher | | | 51 | | | Chairman of the Company’s issued and outstanding shares of Common Stock as of the Record Date must be present at the Annual Meeting, either in person or by proxy, in order to hold the Annual Meeting and conduct business. This is called a quorum.Board | Sean Ainsworth | | | 53 | | | Director | James Manuso | | | 72 | | | Director | Richard Rodgers | | | 54 | | | Director | Susan Benton | | | 56 | | | Director | Jay Pepose | | | 66 | | | Director Nominee |

Q: | How many votes must the director nominees have to be elected? |

A: | In order for a director to be elected, he must receive the affirmative vote of a plurality of the shares voted. There is no cumulative voting for our directors or otherwise. |

Q: | What are the voting requirements to approve the other proposals? |

A: | The affirmative vote of a majority of the shares cast in person or represented by proxy at the Annual Meeting and entitled to vote on the matter is required to ratify the Company’s independent auditors, approve our executive compensation, to approve the amendment to the Company’s stock option plan and to approve an adjournment of the Annual Meeting The affirmative vote of a majority of the Company’s issued and outstanding shares is required to approve the reverse stock split and authorized share reduction. A plurality of the votes will be considered the shareholders’ preferred frequency for holding the non-binding vote on executive compensation. |

Q: | Who will count the votes? |

A: | Votes at the Annual Meeting will be counted by an inspector of election, who will be appointed by the Board of Directors or the chairman of the Annual Meeting. |

Q: | What is the effect of not voting? |

A: | If you are a beneficial owner of shares in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions then, under applicable rules, the broker, bank or other nominee that holds your shares can generally vote on “routine” matters, but cannot vote on “non‑routine” matters. In the case of a non-routine item, your shares will be considered “broker non-votes” on that proposal. |

Proposal 2 (ratificationWe believe each of the appointment of Baker Tilly Virchow Krause, LLP asBoard’s nominees meets the independent registered public accounting firm), Proposal 6 (approvalqualifications, skills and expertise established by the Board for continuing service on the Board, including regarding areas that are critical to the Company’s strategy and operations, and will continue to collectively serve in the best interests of the reverse stock splitstockholders and authorized share reduction)the Company.

All directors are elected annually and Proposal 7 (approvalwill serve one-year terms until the 2022 annual meeting of stockholders or until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. The Board has affirmatively determined that each of the adjournmentdirector nominees, except Ms. Sooch and Mr. Pepose, are independent under the applicable rules of the Nasdaq Capital Market (“Nasdaq”). Each nominee has consented to be listed in this proxy statement and agreed to serve as a director if elected by the shareholders. If any nominee becomes unable or unwilling to serve between the date of this proxy statement and the Annual Meeting, which we do not anticipate, the Board may designate a new nominee and the persons named as proxies in the attached proxy card will vote for that substitute nominee (unless the proxies were previously instructed to withhold votes for the nominee who has become unable or unwilling to serve). Alternatively, the Board may reduce the size of the Board. All directors will be elected by a plurality of the votes present in person or represented by proxy at the Annual Meeting and entitled to vote. This means that the individuals nominated for election to the Board at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” each nominee or “WITHHOLD” your vote with respect to each nominee. Shares represented by proxies will be voted “FOR” the election of each nominee, unless the proxy is marked to withhold authority to so vote. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 6) are matters we believe will be considered “routine.” Proposal 1 (election of directors), Proposal 3 (non-binding approval of the Company’s executive compensation), Proposal 4 (non-binding recommendation of the frequency of future non-binding votes on executive compensation) and Proposal 5 (amendment to the 2013 Plan) are matters we believe will be considered “non-routine.” If you are a Shareholder of Record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting. If you are a Shareholder of Record and you properly sign and return your Proxy Card, your shares will be voted as you direct. If no instructions are indicated on such Proxy Card and you are a Shareholder of Record, shares represented by the proxy will be voted in the manner recommended by the Board of Directors on all matters presented in this Proxy Statement, namely “FOR” all the director nominees, “FOR” the ratification of the appointment of Baker Tilly as the Company’s independent registered public accounting firm for the year ending December 31, 2017, “FOR” the non-binding vote on the Company’s executive compensation, “EVERY THREE YEARS” for the frequency of future non-binding votes on executive compensation, “FOR” the approval of the amendment to the 2013 Plan, “FOR” the approval of the reverse stock split and authorized share reduction, and “FOR” the adjournment of the Annual Meeting, if necessary.

Q: | How are broker non-votes and abstentions treated? |

A: | Broker non-votes and abstentions with respect to a proposal are counted as present or represented by proxy for purposes of establishing a quorum. If a quorum is present, broker-non votes and votes to withhold will have no effect on the outcome of the votes on Proposal 1 (election of directors), but abstentions will count as votes against Proposal 2 (ratification of the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm), Proposal 3 (non-binding approval of the Company’s executive compensation), Proposal 4 (non-binding recommendation of the frequency of future non-binding votes on executive compensation), Proposal 5 (amendment to the 2013 Plan) and Proposal 7 (approval of the adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes to approve Proposal 6), and broker non-votes and abstentions will have the same effect as votes against Proposal 6 (approval of the reverse stock split and authorized share reduction). |

Q: | Can I revoke my proxy or change my vote after I have voted? |

A: | You may revoke your proxy and change your vote by voting again via the Internet or telephone, by completing, signing, dating and returning a new Proxy Card or voting instruction form with a later date, or by attending the Annual Meeting and voting in person. Only your latest dated Proxy Card received at or prior to the Annual Meeting will be counted. Your attendance at the Annual Meeting will not have the effect of revoking your proxy unless you forward written notice to the Secretary of the Company at the above stated address or you vote by ballot at the Annual Meeting. |

Q: | What does it mean if I receive more than one Proxy Card? |

A: | It means that you have multiple accounts at the transfer agent and/or with brokers, banks or other nominees. To ensure that all of your shares in each account are voted, please sign and return all Proxy Cards, vote with respect to all accounts via the internet or by telephone, or, if you plan to vote at the Annual Meeting, contact each broker, bank or other nominee so that you can receive all necessary legal proxies to present at the Annual Meeting. |

Q: | What are the costs of soliciting these proxies and who will pay? |

A: | We will bear the costs of preparing, printing, assembling, and mailing the Proxy Materials and of soliciting proxies. In addition to solicitations by mail, the Company and its directors, officers and employees may solicit proxies by telephone and email. We will request brokers, custodians and fiduciaries to forward proxy soliciting material to the owners of shares of our Common Stock that they hold in their names. We will reimburse banks and brokers for their reasonable out-of-pocket expenses incurred in connection with the distribution of our proxy materials. |

Q: | Do I have appraisal or similar dissenter’s rights? |

A: | Appraisal rights and similar rights of dissenters are not available to shareholders in connection with proposals brought before the Annual Meeting. |

Q: | Where can I find the voting results of the Annual Meeting? |

A: | The Board of Directors will announce the voting results at the Annual Meeting. We will also publish the results in a Current Report on Form 8-K within four business days after the date of the Annual Meeting. We will file that report with the SEC, and you can get a copy: |

| · | by contacting the Company’s corporate offices via phone at (240) 268-5300 or by e-mail at ir@rexahn.com; or |

| · | through the SEC’s EDGAR system at www.sec.gov or by contacting the SEC’s public reference room at 1-800-SEC-0330.

|

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS

The table below sets forth the beneficial ownership of our Common Stock as of February 21, 2017 by the following individuals or entities:

| · | each director and nominee; |

| · | each named executive officer identified in the Summary Compensation Table; and |

| · | all current directors and executive officers as a group. |

As of February 21, 2017, no person or group of affiliated persons is known to us to beneficially own 5% or more of our outstanding Common Stock.

As of February 21, 2017, 237,443,785 shares of our Common Stock were issued and outstanding. Unless otherwise indicated, all persons named as beneficial owners of our Common Stockproxies may vote for a substitute nominee chosen by the present Board, or the Board will have sole voting power and sole investment power with respect toa vacancy, which it may fill at a later date or reduce the shares indicated as beneficially owned. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock that will be subject to options or other convertible securities held by that person that are exercisable as of February 21, 2017, or will become exercisable within 60 days thereafter, are deemed outstanding, while such shares are not deemed outstanding for purposes of computing percentage ownership of any other person. In addition, unless otherwise indicated, the address for each person named below is c/o Rexahn Pharmaceuticals, Inc., 15245 Shady Grove Road, Suite 455, Rockville, Maryland 20850.

| | | Shares of Rexahn Pharmaceuticals Common Stock Beneficially Owned | | | Name of Beneficial Owner | | Number of Shares | | | Percentage | | | Directors and Executive Officers: | | | | | | | | Chang H. Ahn | | | 7,745,294 | (1) | | | 3.3 | % | | Peter Suzdak | | | 3,109,189 | (2) | | | 1.3 | % | | Charles Beever | | | 340,000 | (3) | | | * | | | Kwang Soo Cheong | | | 333,000 | (4) | | | * | | | Peter Brandt | | | 420,000 | (5) | | | * | | | Mark Carthy | | | 170,000 | (6) | | | * | | | Richard J. Rodgers | | | 120,000 | (7) | | | * | | | Tae Heum Jeong | | | 1,393,435 | (8) | | | * | | | Ely Benaim | | | 904,984 | (9) | | | * | | | Lisa Nolan | | | - | | | | * | | | All current executive officers and directors as a group (10 persons) | | | 14,535,902 | (10) | | | 6.1 | % |

* | Represents less than 1% of the issued and outstanding shares of the Company’s Common Stock as of the February 21, 2017.

|

(1) | Includes Dr. Ahn’s options to purchase 1,235,294 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017 and 500,000 shares held by Dr. Ahn’s spouse.

|

(2) | Includes Dr. Suzdak’s options to purchase 3,049,189 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017. |

(3) | Includes Mr. Beever’s options to purchase 330,000 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017.

|

(4) | Includes Dr. Cheong’s options to purchase 330,000 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017.

|

(5) | Includes Mr. Brandt’s options to purchase 270,000 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017.

|

(6) | Includes Mr. Carthy’s options to purchase 170,000 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017.

|

(7) | Includes Mr. Rodgers’ options to purchase 120,000 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017.

|

(8) | Includes Dr. Jeong’s options to purchase 888,435 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017.

|

(9) | Includes Dr. Benaim’s options to purchase 904,984 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017.

|

(10) | Includes options to purchase 7,297,902 shares of Common Stock that are currently exercisable or exercisable within 60 days of February 21, 2017.

|

PROPOSAL 1: ELECTION OF DIRECTORS

Seven director nominees have been nominated for election at the Annual Meeting to serve a one-year term until the next Annual Meeting in 2018. Allsize of the nominees currently serve as directors of the Company. All nomineesBoard. We have consented to being named in this Proxy Statement and to serve if elected.

The Board of Directors recommends that the nominees listed below be elected as directors of the Company. The Company has no reason to believe that any of the nominees will not be a candidate ornominee will be unwilling or unable to serve. However, in the event that any of the nominees should become unable or unwilling to serve if elected as a director, the persons named in the proxy have advised that they will vote (unless authority has been withdrawn) for the election of such person or persons as shall be designated by management.

The following table sets forth the names, ages and positions of our nominees for directors. All ofdirector. Additional information regarding the director nominees are currently members of our Board of Directors.is set forth below.

Name

| Age

| Position

| Peter Brandt | 59 | Chairman of the Board of Directors | Chang H. Ahn | 65 | Chairman Emeritus, Director and Chief Scientist | Peter Suzdak | 58 | Chief Executive Officer and Director | Charles Beever | 64 | Director | Mark Carthy | 56 | Director | Kwang Soo Cheong | 55 | Director | Richard J. Rodgers | 50 | Director |

Mina Sooch

Peter Brandt. Mr. BrandtMina Sooch, MBA, has served as our Chairman since June 2015 and as director since September 2010. From February 2011 to early 2013, Mr. Brandt served on the Board of Directors and, in December 2012, became Chairman of the Board of Directors of ePocrates, Inc., which was acquired by athenahealth, Inc. Also, from November 2011 until March 2012, Mr. Brandt served as interimOcuphire’s Chief Executive Officer, and President, of ePocrates, Inc. Mr. Brandt served as President, Chief Executive Officer,Treasurer, and as a member of the Board since November 2020. Ms. Sooch currently serves as Vice Chair of Directorsthe Board. Prior to that, she served on the Board of Noven Pharmaceuticals,Private Ocuphire since she co-founded it in February 2018 until November 2020. Prior to Private Ocuphire, from November 2014 to May 2017, she served as president, chief executive officer and a member of the board of directors at Gemphire Therapeutics, Inc., a specialty pharmaceuticalprivate to Nasdaq biopharmaceutical company from early 2008 until Noven’s acquisition by Hisamitsu Pharmaceutical Co., Inc. in August 2009. Priorwhich she co-founded. From July 2012 to leading Noven, Mr. Brandt spent 28 years at Pfizer, the world’s largest pharmaceutical company. HeMay 2014, she served as Pfizer’s President – U.S. Pharmaceuticals Operations, where he helped deliver revenuethe president and earnings growth while engineering major change within Pfizer’s U.S. pharmaceuticals organization. Priorchief executive officer of ProNAi Therapeutics, Inc., a private to running U.S. operations, he led Pfizer’s Latin American pharmaceuticals operations,Nasdaq public oncology company, and as a member of the board of directors from its founding in 2004 through May 2014, as well as the following Pfizer Worldwide Pharmaceuticals functions: finance, information technology, planning anda business development. He also oversaw the operations of Pfizer’s care management subsidiary, Pfizer Healthcare Solutions. Mr. Brandt served as a director of Auxilium Pharmaceuticals, Inc. (“Auxilium”)development advisor from December 2010 to January 2015, at which time Auxilium was acquired by Endo International PLC. Mr. Brandt holds a B.A. from the University of Connecticut and an M.B.A. from the Columbia School of Business. Mr. Brandt contributes his broad operational management experience in the life sciences industry and experience serving on numerous boards of directors of life sciences companies to the Board of Directors.

Chang H. Ahn. Dr. AhnJune 2012. In addition, Ms. Sooch has served as Chairman Emeritusmanaging partner of the BoardApjohn Ventures Fund since its founding in 2003, and co-founded two additional life sciences startups, Afmedica, Inc. and Nephrion, Inc. (renamed CytoPherx, Inc.). She also serves as manager of Directors since June 2015, and as the Company’s Chief Scientist since February 2013. Dr. Ahn served as the Company’s Chairman and Chief Executive Officer from the Company’s incorporation as Rexahn, CorpTara Ventures I, LLC, an angel fund organized in May2002 for life sciences investments. From 2001 until the appointment of Dr. Suzdak as Chief Executive Officer in February 2013. From 1988 to 2001, Dr. Ahn2002, Ms. Sooch also served as an Expert Reviewer of anticancerentrepreneur in residence at North Coast Technology Investors LP. Ms. Sooch has served on multiple additional private and antiviral drug products at the U.S. Foodpublic boards including Biovie Inc. (OTC: BIOV), ZyStor Therapeutics, Inc. (sold to Biomarin Pharmaceutical Inc.), Asterand Inc. (ASTD: LSE), CytoPherx Inc. and Drug Administration (the “FDA”) Center for Drug Evaluation and Research. PriorSvelte Medical Systems, Inc. From 2006 to joining the FDA in 1988, Dr. Ahn carried out cancer research at the National Cancer Institute, as well as at Emory University School of Medicine. In 2003 and 2004, Dr. Ahn organized and chaired the U.S.-Korea Bio Business and Partnership Forum. He alsopresent, Ms. Sooch served as presidentadvisory board member at Wolverine Venture Fund, and from 2004 to 2012 as a board member of Michigan Venture Capital Association, and as chair from 2009 to 2010. From 1993 to

TABLE OF CONTENTS 2000, her senior roles included global account manager at Monitor Deloitte (formerly Monitor Company Group), a global strategy consulting firm based in Boston. Ms. Sooch has been the recipient of numerous awards, including being named one of the SocietyDeal Makers of Biomedical Researchthe Year in 2016 by Crain’s Detroit Business. Ms. Sooch received an MBA from 2000Harvard Business School in 1993 and a B.S. in Chemical Engineering, summa cum laude, from Wayne State University in 1989. Ocuphire believes that Ms. Sooch is qualified to 2003. Dr. Ahn holds a Ph.D. in pharmacology from Ohio State University. He also holds B.S. degrees in pharmacy from Creighton Universityserve on the Board due to her experience raising private and Seoul National University. Dr. Ahn’s expertisepublic capital, her experience on the boards of U.S. private and public biotech companies and her over 25 years in the pharmaceutical industry with a focus on business development, finance, strategy and evaluation of new drugs and applicable regulatory frameworks provides technical experiencemanagement in the bioscience industry topharmaceutical industry. Cam Gallagher Cam Gallagher, MBA, currently serves as Chair of the Board of Directors.

Peter Suzdak. Dr. Suzdak joined the Company as Chief Executive Officer in February 2013, and has served as a directormember of the Board since June 2013. Dr. Suzdak has over 25 years of diverse experience, including several management positions, in the pharmaceutical industry. Most recently, Dr. Suzdak was Chief Scientific Officer of Corridor Pharmaceuticals, a company developing small molecule compounds to treat pulmonary and vascular disorders, from 2010 to 2013.November 2020. Prior to Corridor Pharmaceuticals,that, he was co-Founder, Chief Executive Officer and Chief Scientific Officer of Cardioxyl Pharmaceuticals, a company focusedserved on therapies for the treatment of cardiovascular disease, from 2006 to 2009. Prior to Cardioxyl Pharmaceuticals, he was President and Chief Executive Officer of Artesian Therapeutics, a company engaged in the development of small molecule therapeutics for cardiovascular diseases, from 2002 to 2005. Dr. Suzdak’s experience also includes his position as Senior Vice President of Research and Development of Guilford Pharmaceuticals, a company that developed therapeutics and diagnostics for neurological diseases and cancer, from 1995 to 2002, and as Director of Neurobiology for Novo Nordisk from 1988 to 1995. Dr. Suzdak holds a Ph.D. in pharmacology and toxicology from the University of Connecticut. Dr. Suzdak contributes his extensive pharmacology, clinical development, business development, and pharmaceutical management experience, including his day-to-day leadership of the Company, to the Board of Directors.

Charles Beever. Mr. Beever has servedPrivate Ocuphire from January 2019 until November 2020. He serves as chair of Ocuphire’s audit committee and as a director since May 2006. From 1993 to June 2015, he wasmember of the Company’s nominating and corporate governance committee and compensation committee. He is a Vice President of PwC Strategy&, formerly Booz & Companyco-founder and Booz Allen Hamilton (“Booz Allen”), Prior to being elected Vice President of Booz Allen in 1993, he served as staff member and Engagement Manager at Booz Allen from January 1984 to October 1993. Prior to joining Booz Allen, Mr. Beever served in various management roles at McGraw-Edison Company. Mr. Beever holds a B.A. in Economics from Haverford College, where he was elected to Phi Beta Kappa, and an M.B.A. from the Harvard Graduate School of Business Administration. Mr. Beever contributes extensive managerial and business experience to the Board of Directors.

Mark Carthy. Mr. Carthy has served as a director since February 2014. Mr. Carthy is the Managing Partner of Orion Equity Partners, LLC, a healthcare venture capital management and advisory firm co-founded by Mr. Carthy in 2008. Prior to founding Orion, Mr. Carthy was a Venture Partner and General Partner at Oxford Bioscience Partners, an early stage venture capital firm that provides equity financing and management assistance to companies within the life sciences, technology, energy and healthcare sectors. From 1998 until 2000, Mr. Carthy served as the Biotechnology Portfolio Manager at Morningside Ventures, where he focused on early stage private equity investments. Previously, he was Chief Business Officer of Cubist Pharmaceuticals and Senior Director of Business Development at Vertex Pharmaceuticals. Mr. Carthy served as a member of the board of the New England Venture Capital Association from 2006 until 2013 and was listed on the Forbes Midas List in 2009 as onedirectors of the leading venture capitalists. He received a Bachelor of Chemical Engineering from the University College Dublin, Ireland, a Master of Science in Chemical Engineering from the University of Missouri and a Master of Business Administration from the Harvard Graduate School of Business Administration. Mr. Carthy contributes extensive business and industry expertise to the Board of Directors.

Kwang Soo Cheong. Dr. Cheong has served as a director since May 2006. He is a faculty member at the Department of Finance of the Johns Hopkins University Carey Business School, where he was an Assistant Professor from 2001 to 2005 and has been an Associate Professor from 2006 to date. Dr. Cheong was an Assistant Professor of Economics at the University of Hawaii from 1994 to 2001, and a lecturer at the Department of Economics of Stanford University from 1993 to 1994. During the summer of 1995, Dr. Cheong was a Visiting Fellow in the Taxation and Welfare Division at the Korea Development Institute in Korea. Dr. Cheong holds a B.A. in Economics and an M.A. in Economics from Seoul National University, and a Ph.D. in Economics from Stanford University. Dr. Cheong’s distinguished academic career focused on finance and economics contributes to the Board of Directors’ perspective.

Richard J. Rodgers. Mr. Rodgers has served as a directorZentalis Pharmaceuticals (Nasdaq: ZNTL) since December 2014. He has also served on the boards of VelosBio Inc., since October 2017, and SelectION, Inc., since June 2018. In addition to his board seatroles, Mr. Gallagher has served as chief business officer at Immusoft Corporation since March 2019 and at jCyte, Inc. since December 2019. From 2014 to 2016, he was a board member and the chief business officer at RetroSense Therapeutics, LLC, which was acquired by Allergan in 2016. In June 2007, Mr. Gallagher co-founded Nerveda, LLC, a life sciences seed fund, and served as managing director. Prior to these roles, from 1992 to 2007, he held management positions at Verus Pharma B.V., CV Therapeutics, Inc. and Dura Pharmaceuticals, Inc. Mr. Gallagher holds an MBA from the University of San Diego in 1997 and a B.S. in Business Administration from Ohio University in 1992. Ocuphire believes that Mr. Gallagher is qualified to serve on the Board as a result of his more than 28 years of experience in the life science and biotech industries with a focus on corporate development, finance, marketing business development and early-stage investing, as well as his experience on the boards of various U.S. private and public companies.

Sean Ainsworth Sean Ainsworth, MBA, currently serves as the Lead Independent Director of the Board, of which he has served as a member since November 2020. Prior to that, he served on the Board of Private Ocuphire from April 2018 until November 2020. He serves as chair of Ocuphire’s Compensation Committee and a member of Ocuphire’s Audit Committee. Since 2018, Mr. Ainsworth has been chief executive officer and chairman of the board at Immusoft Corporation, a cell therapy company. Previously, in 2009, he founded RetroSense Therapeutics LLC, an ocular gene therapeutic company, which was acquired by Allergan in 2016. From 2004 to 2012, Mr. Ainsworth served as chief executive officer of GeneVivo, LLC. In 2006, Mr. Ainsworth co-founded Compendia BioScience, Inc. From 2004 to 2012, Mr. Ainsworth served as an advisor to clients in the life sciences and entrepreneurial community on matters related to licensing, strategy and business planning. His other professional experience includes research at Medical Biology Institute, intellectual property roles at Koyama and Associates in Tokyo and international corporate development consulting at the Mattson Jack Group. Mr. Ainsworth holds a B.S. in Microbiology from University of California, San Diego, in 1996 and an MBA from Washington University in St. Louis in 2002. Ocuphire believes Mr. Ainsworth is qualified to serve on the Board due to his 25 years in life sciences industry, his experience investing in and managing companies in the industry, his financial and business expertise and his experience on boards of multiple biotech companies. James S. Manuso James S. Manuso, PhD, MBA has served as a member of the Board since November 2020, as chair of Ocuphire’s nominating and corporate governance committee and as a member of the audit committee. Prior to that, he served on the Board of Private Ocuphire from January 2019 until November 2020. From July 2011 until October 2013, Dr. Manuso served as chairman and chief executive officer of Astex Pharmaceuticals, Inc. (Nasdaq: ASTX) and led the sale of Astex Pharmaceuticals, Inc. to Otsuka Pharmaceuticals. In 2013, he was a senior mergers and acquisitions advisor to Otsuka Pharmaceuticals’ executive management. Since 2014, Dr. Manuso has served as chairman and chief executive officer of Talfinium Investments, Inc., an investment entity and financial consultancy. From 2015 until 2018, Dr. Manuso served as President, CEO and Vice Chairman of RespireRx Pharmaceuticals Inc. (OTC:QB:RSPI), a Phase 3-ready, clinical-stage respiratory and neurological pharmaceutical company. Since 2018, Dr. Manuso has served as managing member of Laurelside LLC, a family office, which he founded. Dr. Manuso has served as board TABLE OF CONTENTS chairman and chairman of the audit, governance and nominating, pricing and compensation committees of multiple companies’ boards, including Biotechnology Industry Organization, Novelos Therapeutics, Inc., Merrion Pharmaceuticals Ltd. (MERR:IEX; Dublin, Ireland), Inflazyme Pharmaceuticals, Inc. (IZP-TSE; Vancouver, Canada), Symbiontics, Inc., which he co-founded (sold to BioMarin Pharmaceutical Inc. as ZyStor, Inc.), Montigen Pharmaceuticals, Inc., Quark Pharmaceuticals, Inc., Galenica Pharmaceuticals, Inc., Supratek Pharma, Inc., EuroGen, Ltd. (London, UK), where he was chairman, and the Greater San Francisco Bay Area Leukemia & Lymphoma Society, where he also served as vice president. Dr. Manuso holds a B.A. with honors in Economics and Chemistry from New York University, a Ph.D. in Experimental Psychology and Genetics from the New School University, and an Executive MBA from Columbia Business School. Ocuphire believes that Dr. Manuso is qualified to serve on the board of directors of the Company due to his over 25 years of experience in the biopharmaceutical industry in finance, business development and management, and his experience as a member of the boards of directors of multiple pharmaceutical companies, both domestic and foreign. Richard Rodgers Richard Rodgers has served on our Board and as chair of the Audit Committee and member of the compensation committee since November 2020. Mr. Rodgers previously served as a member of the board of Rexahn from 2014 until November 2020. Mr. Rodgers currently serves on the Boardboard of Directorsdirectors of Ardelyx, Inc. (Nasdaq: ARDX), a publicly traded pharmaceutical company, and 3-Vthe board of directors of Sagimet Biosciences, Inc., a privately held clinical stage pharmaceutical company. Mr. Rodgers was previously Executive Vice President, Chief Financial Officer, Secretary and Treasurer of TESARO, Inc., an oncology-focused biopharmaceutical company that he co-founded, from March 2010 until August 2013. He served as the Chief Financial Officer from June 2009 to February 2010 of Abraxis BioScience, Inc. which was subsequently acquired by Celgene.Celgene Corporation. Prior to that, Mr. Rodgers served as Senior Vice President, Controller and Chief Accounting Officer of MGI PHARMA, INC., from 2004 until its acquisition by Eisai Co., Ltd. in January 2008. He has held finance and accounting positions at several private and public companies, including Arthur Anderson. Mr. Rodgers received a B.S. in Financial Accounting from St. Cloud State University and his MBA in Finance from the University of Minnesota, Carlson School of Business. Ocuphire believes that Mr. Rodgers’ contributesRodgers is qualified to serve on the Board because of his extensive financial andbackground, industry experience and service on other boards of directors of publicly traded companies. Susan K. Benton Susan K. Benton, MBA, has served on our Board since November 2020. Previously, Ms. Benton has served as the General Manager and Head of the U.S. for Thea Pharma, Inc., a wholly-owned subsidiary of Thea Laboratories, a leading independent ophthalmic pharmaceutical company, since August 2019. Ms. Benton also serves on the boards of two privately held ophthalmic companies, Tarsius Pharma Ltd, since March 2019, and Translatum Medicus, Inc., since July 2019. From April 2015 through July 2019, she served in a number of key leadership positions at Shire, Inc. (“Shire”) and played an instrumental role in the expansion of its ophthalmic pipeline. As the Head of New Products at Shire, she led the Ophthalmic Innovation Committee that shaped and executed the growth strategy for the franchise. Before joining Shire, Ms. Benton served in a leadership capacity in Global Business Development for Bausch + Lomb Pharmaceuticals (“B+L”) from September 2011 through September 2013, where she and the Corporate Development team transacted over ten deals in three years. She was a co-Founder and CCO for an ophthalmic start-up, Sirion Therapeutics, Inc., where she launched and oversaw the commercialization of Durezol® and Zirgan® before they were sold to Alcon and B+L, respectively. Ms. Benton began her ophthalmic career at B+L in March 1995, where she assumed leadership roles as the Head of Diversified Products and the VP of Professional Sales. During her tenure, she launched B+L’s first ever branded products, Lotemax® and Alrex®, in addition to Optivar® through a co-promote with Muro Pharmaceutical. She has also served as a strategic consultant for more than a dozen start-up ophthalmic companies. Her experience outside of ophthalmology includes roles as the VP of Consumer and Professional Sales for Johnson & Johnson’s diabetes franchise, LifeScan, and senior manager roles in Sanofi Pasteur’s vaccine business. Ms. Benton earned her MBA from the University of South Florida and a BS in Biology from Muhlenberg College. Ocuphire believes that Ms. Benton is qualified to serve on the Board given her 30 years’ experience in life sciences with over 20 years focused in ophthalmology. Jay Pepose Dr. Jay Pepose is a nominee to serve on our Board. Dr. Pepose is a board-certified ophthalmologist specializing in cataract, corneal, and refractive surgery and a recognized leader in ophthalmic pharmaceutical and device development. He is the founder and an attending surgeon of Pepose Vision Institute and Professor of Clinical TABLE OF CONTENTS Ophthalmology and Visual Sciences at Washington University School of Medicine, where he held the Bernard Becker Chair. In 1999, Dr. Pepose founded the Pepose Vision Institute, MidAmerica Surgery Center and Midwest Laser Center, now with multiple locations, 6 doctors and 54 staff. In October 2019, these entities were acquired by the Firmament PE group, along with a number of other regional and national ophthalmology practices. Since the acquisition, Dr. Pepose serves as a Board Member and President of Midwest Vision Partners, the midwest division of Vision Integrated Partners (VIP). VIP is Firmament’s management company, servicing a national consortium of practices and ambulatory surgery centers located in Missouri, Illinois, Ohio, Florida and California. Dr. Pepose is also President of Midwest Vision Research Foundation, a non-profit clinical research organization that conducts ophthalmic clinical trials. He also is a co-founder and board member of 911 Vision Foundation, a non-profit charity that provides free LASIK surgery for first responders in the greater St. Louis area. Ocuphire believes that Dr. Pepose is qualified to serve on the Board given his vast experience in life sciences and focus in ophthalmology. The Merger, Reverse Stock Split and Name Change On November 5, 2020, Ocuphire (formerly known as Rexahn Pharmaceuticals, Inc., and prior to the Boardmerger, referred to as “Rexahn”), completed its business combination with Ocuphire Pharma, Inc. (“Private Ocuphire”), in accordance with the terms of Directors.the Agreement and Plan of Merger, dated as of June 17, 2020, as amended, by and among Rexahn, Private Ocuphire, and Razor Merger Sub, Inc., a wholly-owned subsidiary of Rexahn (“Merger Sub”) (as amended, the “Merger Agreement”), pursuant to which Merger Sub merged with and into Private Ocuphire, with Private Ocuphire surviving as a wholly-owned subsidiary of Rexahn (the “Merger”).

In connection with, and immediately prior to the completion of, the Merger, Rexahn effected a reverse stock split of the common stock, at a ratio of 1-for-4 (the “Reverse Stock Split”). Under the terms of the Merger Agreement, after taking into account the Reverse Stock Split, Rexahn issued shares of its common stock to Private Ocuphire stockholders, based on a common stock exchange ratio of 1.0565 shares of common stock for each share of Private Ocuphire common stock. In connection with the Merger, Rexahn changed its name from “Rexahn Pharmaceuticals, Inc.” to “Ocuphire Pharma, Inc.,” and the business conducted by Rexahn became the business conducted by Private Ocuphire.

The BoardNon-Employee Director Compensation

Pre-Merger Compensation Prior to the Merger, directors of Directors recommends a vote FOR the election of eachCompany were compensated as follows: Director | | | $40,000 per annum, plus an additional $25,000

for the Chairman of the Board | Audit Committee (Chair) | | | $15,000 per annum | Audit Committee (Member) | | | $7,500 per annum | Compensation Committee (Chair) | | | $10,000 per annum | Compensation Committee (Member) | | | $5,000 per annum | Nominating and Corporate Governance Committee (Chair) | | | $7,500 per annum | Nominating and Corporate Governance Committee (Member) | | | $3,750 per annum | Business Development Committee (Chair) | | | $10,000 per annum | Business Development Committee (Member) | | | $5,000 per annum |

As part of the director nominees.compensation structure, each incumbent non-employee director received an annual equity grant equal to 0.088% of the outstanding shares of Rexahn at the time of grant. Rexahn also had an informal policy to grant each incoming director an equity award equal to twice the annual grant. Post-Merger Compensation In June 2020, our Board approved a non-employee director cash and equity compensation plan effective as of the closing of the Merger on November 5, 2020. Under this policy, the Company agreed to pay each of its non-employee Executive OfficersTABLE OF CONTENTS directors a cash stipend for service on its board of directors and, if applicable, on the audit committee, compensation committee and nominating and corporate governance committee. Each of the Company’s non-employee directors receives an additional stipend for service as the chairperson of the compensation committee, nominating and corporate governance committee or audit committee or service as the non-executive chairperson. The stipends payable to each non-employee director for service on the Company’s Board are as follows: Board of directors | | | $40,000 | | | $35,000 | Audit committee | | | 7,500 | | | 15,000 | Compensation committee | | | 5,000 | | | 10,000 | Nominating and corporate governance committee | | | 4,000 | | | 8,000 | Lead Independent Director | | | 20,000 | | | — |

(1)

| Chairs of each committee do not receive a stipend for being a member of the applicable committee. |

Non-Employee Director Compensation in 2020

In addition to Peter Suzdak, whoseThe following table provides compensation information is included above, set forth below arefor the fiscal year ended December 31, 2020 for each non-employee member of the Board.

Cam Gallagher(2) | | | 13,011 | | | 13,508 | | | 26,519 | Sean Ainsworth(2) | | | 12,004 | | | 13,508 | | | 25,512 | James Manuso(2) | | | 8,596 | | | 13,508 | | | 22,104 | Richard Rodgers | | | 60,163 | | | 141,695 | | | 201,858 | Susan Benton(2) | | | 6,815 | | | 141,695 | | | 148,510 | Alan Meyer(2) | | | 6,196 | | | 20,263 | | | 26.459 | Charles Beever(3) | | | 48,750 | | | — | | | 48,750 | Kwang Soo Cheong(3) | | | 43,451 | | | — | | | 43,451 | Ben Gil Price(3) | | | 42,391 | | | — | | | 42,391 | Lara Sullivan(3) | | | 45,571 | | | — | | | 45,571 | Peter Brandt(3) | | | 69,946 | | | — | | | 69,946 |

(1)

| The amounts reported reflect the aggregate grant date fair value of each equity award granted to the Company’s non-employee directors during the fiscal year ended December 30, 2020, as computed in accordance with ASC 718. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. |

(2)

| Appointed as a director on November 5, 2020 following the effective time of the Merger. |

(3)

| Mr. Beever, Mr. Cheong, Mr. Price, Ms. Sullivan and Ms. Brandt resigned from the Board on November 5, 2020, pursuant to the Merger Agreement. |

As named executive officers of the Company:

Tae Heum Jeong. Dr. Jeong, 46, has served asCompany, compensation paid to Ms. Sooch and Mr. Swirsky, our former Chief FinancialExecutive Officer and Secretary since May 2005 and was a director from June 2005 to June 2012. Dr. Jeong served as Chief Financial Officer of Rexahn, Corp from December 2002 to May 2005. From 1997 to(who resigned on November 2002, Dr. Jeong served as a senior investment manager at Hyundai Venture Investment Corporation, a venture capital firm where he managed the biotech investment team. He was also a committee member of the Industrial Development Fund of Korea’s Ministry of Commerce, Industry and Energy from 2000 to 2002. Dr. Jeong holds a Doctor of Management from the University of Maryland, an M.S. in Finance from Johns Hopkins University, and a B.S. and an M.S., in Chemistry, from POSTECH.

Ely Benaim. Dr. Benaim, 56, has served as Chief Medical Officer since February 2015. Prior to joining Rexahn, Dr. Benaim was Senior Vice President of Regulatory Affairs & Chief Medical Officer of Berg Pharma from June 2013 to January 2015. Prior to joining Berg Pharma, from March 2011 to June 2013, Dr. Benaim was Global Clinical Development Leader at Millennium Pharmaceuticals Inc., where he oversaw global clinical development of the Aurora A kinase inhibitor program. Prior to joining Millennium, Dr. Benaim served as Vice President of Clinical Affairs for Sangamo BioSciences, where he lead the development of zinc-fingers transcription factors cellular therapies in the areas of Cancer, Diabetes, Neurology, Cardiovascular and HIV. Before Sangamo, Dr. Benaim served at Amgen as Global Clinical Lead for clinical development across several drug development programs. Prior to Amgen he was a Senior Director, Oncology Clinical Development at Salmedix, Inc., where he led the development of TREANDA® to a Phase 3 pivotal trial for lymphoma. Dr. Benaim received his M.D. from the Universidad Central de Venezuela, Caracas and completed his pediatric residency training at the University of South Florida. He completed fellowships in pediatric oncology and bone marrow transplantation at St. Jude's Children's Research Hospital, in Memphis, Tennessee. From 1997 to 2004, he was Assistant Professor in the Department of Pediatrics at the University of Tennessee and an Assistant Member5, 2020, pursuant to the Department of Hematology/Oncology.Merger Agreement) for fiscal 2020 is fully reflected under “Summary Compensation Table for Fiscal Year 2020.”

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE Lisa Nolan.“FOR” Dr. Nolan, 54, has served as Chief Business Officer since June 2016. Prior to this, she served as Chief Business Officer of Relmada Therapeutics, Inc. from April 2015 to June 2016. From March 2010 through June 2016. Dr. Nolan served as Managing Director of Nolex Advisors, LLC, where she led successful competitive processes for out-licensing of early and late-stage pharmaceutical products. Over the course of her career, Dr. Nolan has held various leadership roles at biopharmaceutical companies including Chief Business Officer at Topigen Pharmaceuticals, where she led the acquisition of Topigen by Pharmaxis. Additionally, she served as Vice President, Global Business Development and Strategic Marketing for SkyePharma Inc., where she completed over a dozen out-licensing deals in the U.S. and Europe with deal values ranging in excess of $500 million. Dr. Nolan holds a Ph.D. in clinical pharmacology and a M.Sc., and B.Sc., in pharmacy from Trinity College in Dublin, Ireland.THE ELECTION OF EACH OF THE NOMINATED DIRECTORS. Director IndependenceTABLE OF CONTENTS BOARD AND COMMITTEE INFORMATION

Our Common Stock is listed onWe are committed to good corporate governance practices. These practices provide an important framework within which our Board and management pursue our strategic objectives for the NYSE MKT. We use the NYSE MKT definition of “Independent Director” in determining whether a director is independent in his capacity as a director and in his capacity as a member of a board committee. For the Audit Committee, we additionally use Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Each director serving on our Audit Committee must also comply with the following additional NYSE MKT requirements:

(a) the director must not have participated in the preparationbenefit of our financial statements or any current subsidiary at any time during the past three years; and

(b) the director must be able to read and understand fundamental financial statements, including our balance sheet, income statement, and cash flow statement.

We currently have a total of seven directors, five of whom are Independent Directors. Our Independent Directors are Messrs. Brandt, Beever, Carthy and Rodgers and Dr. Cheong.

stockholders.

Board Leadership Structure

Our Board is currently chaired by Cam Gallagher, who has authority, among other things, to call and preside over meetings of our Board, to set meeting agendas and to determine materials to be distributed to the Board and, accordingly, has substantial ability to shape the work of the Board. The positions of our chairman of the Board and Chief Executive Officer are presently separated. Separating these positions allows our Chief Executive Officer, Ms. Sooch, to focus on our day-to-day business, while allowing Mr. Gallagher to lead the Board.

Role of the Board in Risk Oversight Our Board of Directors does not have a policy on whetherstanding risk management committee, but rather administers this oversight function directly through their Board as a whole. The Board’s risk oversight is administered primarily through the rolefollowing: review and approval of Chairmanan annual business plan; review of a summary of risks and opportunities at meetings of the Board; review of business developments, business plan implementation and financial results; oversight of internal controls over financial reporting; and review of employee compensation and its relationship to our business plans. Director Independence Nasdaq listing standards require that the Company’s board of directors consist of a majority of independent directors, as determined under the applicable rules and regulations of Nasdaq. Based upon information requested from and provided by each proposed director concerning his or her background, employment and affiliations, including family relationships, the Company believes that each current member of the Board qualifies as an “independent director” as defined under the applicable rules and regulations of the SEC and the listing requirements and rules of Nasdaq, except Ms. Sooch, the Company’s President and Chief Executive Officer, should be separate or combined. However, atand Mr. Meyer, a director on the present time, these roles are separate. Our Board and former consultant of Directors believesthe Company. In making such independence determinations, the Board considers the current and prior relationships that utilizing separate individuals as Chairman and Chief Executive Officer will provide for additional leadership and management perspective aseach non-employee director has with the Company progressesand all other facts and circumstances that the Board deems relevant in determining each non-employee director’s independence, including the development of its drug candidates. Five of our seven director nominees are independentparticipation by the Company’s non-employee directors, or their affiliates, in certain financing transactions and each of our standing committees (Audit, Nominating and Corporate Governance, and Compensation) is comprised solely of independent directors. We believe this structure provides adequate oversight of Company operations by our independent directors in conjunction with our Chairman and Chief Executive Officer.

Our Audit Committee has primary responsibility for oversight of risk management on behalfthe beneficial ownership of the BoardCompany’s common stock by each non-employee director.

Structure and Operation of Directors. Management reportsthe Board Because our Common Stock listed on Nasdaq, the Company is subject to the Audit Committee on matters relating to risk management andNasdaq listing requirements regarding committee matters. The Company currently has the Audit Committee and management communicate directly with the full Board of Directors on these matters.

Board of Directors and Board of Directors Meetings

The Board of Directors of the Company held seven meetings during the year ended December 31, 2016. Each current director attended 75% or more of the meetings of the Board of Directors and committees of which they were members during the period in which he or she served as a director during the year ended December 31, 2016.